38 the coupon rate of a bond is equal to

All else constant, a bond will sell at _____ when the coupon rate is ... All else constant, a bond will sell at _____ when the coupon rate is _____ the yield to maturity. 1.A premium; equal to, 2.Par; less than, 3.A discount; less than, 4.A discount; higher than, 5.A premium; less than The coupon rate of a bond equals ______. a. its yield to ... The coupon rate is the defined percentage of the bond's face value. where coupon amount equals (Face value of the bonds × Coupon rate). c. the yield to maturity ...A. its yield to maturity: The coupon rate is not the ...1 answer · Top answer: Correct Answer: Option b. a defined percentage of its face value. Explanation: a. its yield to maturity The coupon rate is not the same as the ...

If coupon rate is equal to going rate of interest then - Examveda Solution (By Examveda Team) If coupon rate is equal to going rate of interest then bond will be sold at par value. A coupon payment on a bond is the annual interest payment that the bondholder receives from the bond's issue date until it matures. Coupons are normally described in terms of the coupon rate, which is calculated by adding the sum ...

The coupon rate of a bond is equal to

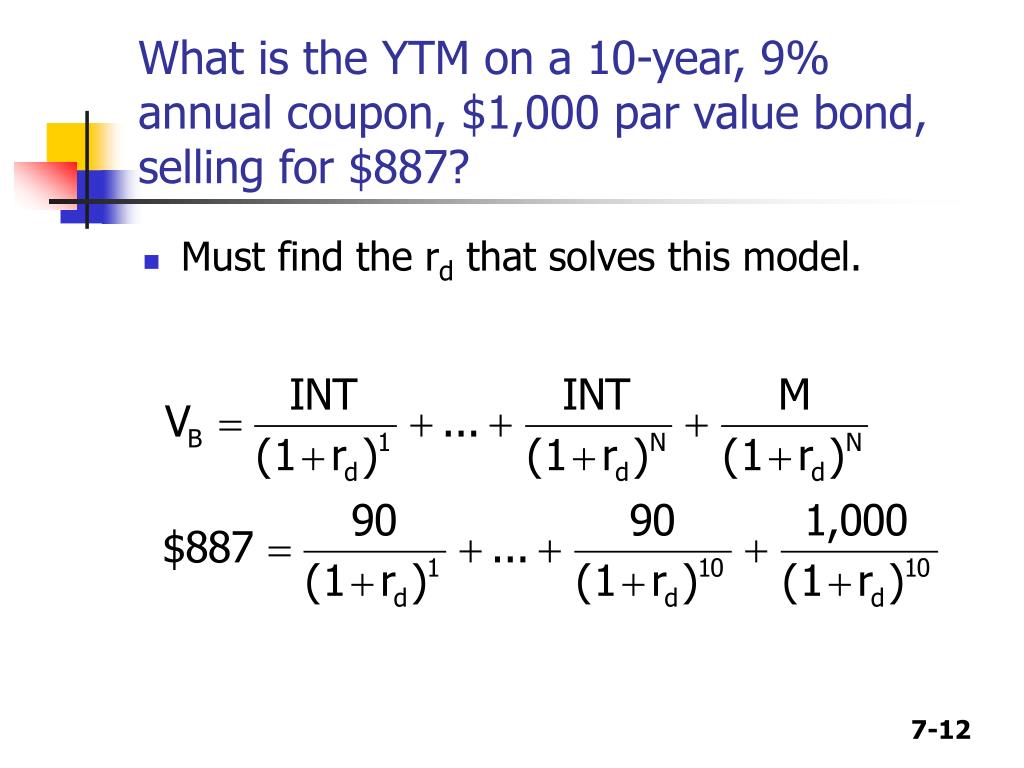

If the coupon rate of a bond is equal to its required rate of return ... When the coupon rate of a bond equal to its required rate of return, then it is purchased at par since the initial investment is totally offset by repayment of the bond at maturity, leaving only the fixed coupon payments as profit. The correct answer is - is equal to par value. New questions in Business Why is the yield to maturity of a bond equal to the coupon rate ... Bonds fixed coupon rate is the annual interest that is given to a bondholder. Whereas yield to maturity is the rate of return that is expected from the bond if ...3 answers · 2 votes: Why is the yield to maturity of a bond equal to the coupon rate at the time of the issue? ... Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value.

The coupon rate of a bond is equal to. Solved If the coupon rate of a bond is equal to its required - Chegg This problem has been solved! See the answer If the coupon rate of a bond is equal to its required rate of return, then ________. Select one: a. the current value is not equal to par value b. the current value is equal to par value c. the maturity value is equal to par value d. the current value is equal to maturity value Expert Answer The yield to maturity on a bond is a below the coupon rate when the ... A 10 - year bond with zero coupon will be more sensitive to interest rate change than a 10 - year bond that pays a 6 % annual coupon . 49. A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is CORRECT? a. dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... Finance Ch 6 Flashcards & Practice Test - Quizlet What condition must exist if a bond's coupon rate is to equal both the bond's current yield and its yield to maturity? Assume the market rate of interest for this bond is positive. A. The clean price of the bond must equal the bond's dirty price. B. The bond must be a zero coupon bond and mature in exactly one year. C.

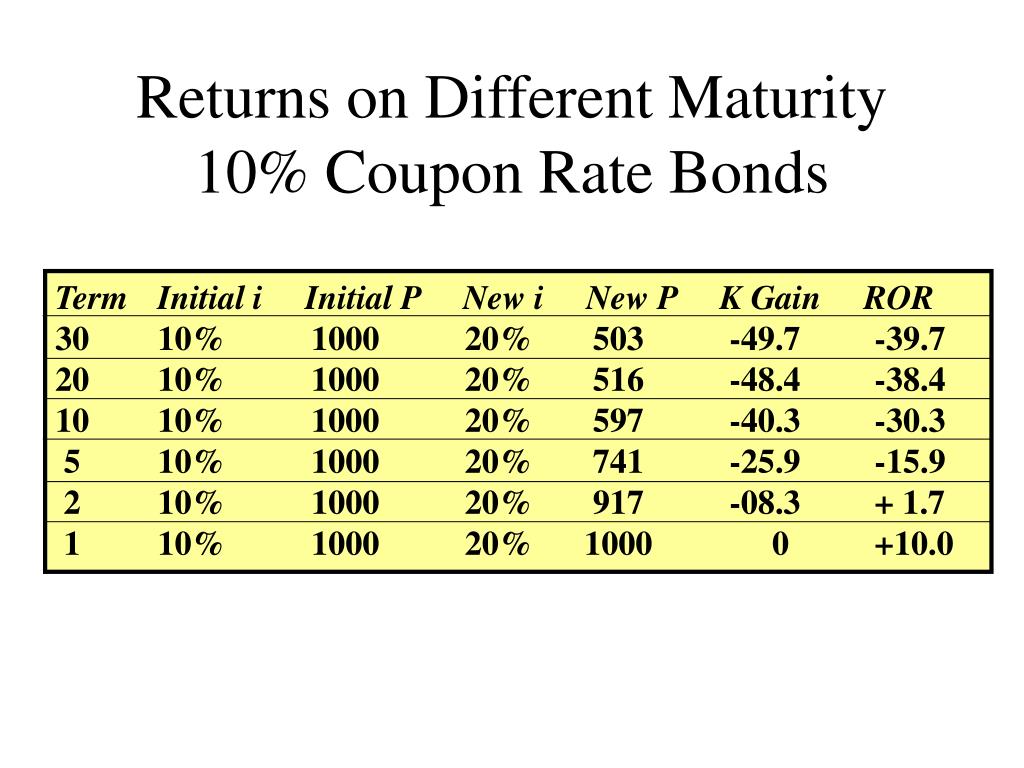

When is a bond's coupon rate and yield to maturity the same? The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year. So if... While calculating the cost of debt, why isn't the coupon rate of a bond ... The coupon rate for a bond is established up front before the bond is sold to investors. It will depend on current interest rates, how long until the bond matures and the credit quality of the issuer. The coupon rate is fixed for the life of the bond. You will be paid the same amount two times a year regardless of what the price of the bond is. › terms › zZero-Coupon Bond Definition - Investopedia Nov 11, 2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The bond price varies based on the coupon rate and the prevailing market rate of interest. If the coupon rate is lower than the market interest rate, then the bond is said to be traded at a discount, while the bond is said to be traded at a premium if the coupon rate is higher than the market interest rate.

A bond's coupon rate is equal to the annual interest ... - Soetrust A bond coupon rate equal to the annual interest divided by which of the following? Coupon; Maturity; Face Value; Yield to Maturity; ANSWER: 3. Face Value. Check out Recently Added Questions & Answers on Finance. Realistic rate of return is defined as adjusted rate, which of the following? › terms › cCoupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Suppose a bond has a market price of $90 and has five years remaining ... Suppose a bond has a market price of $90 and has five years remaining to maturity. If the bond is priced to yield 5%, is its coupon rate greater than, less than, or equal to 5%? Explain your reasoning. corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money . The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than $100 in one year.

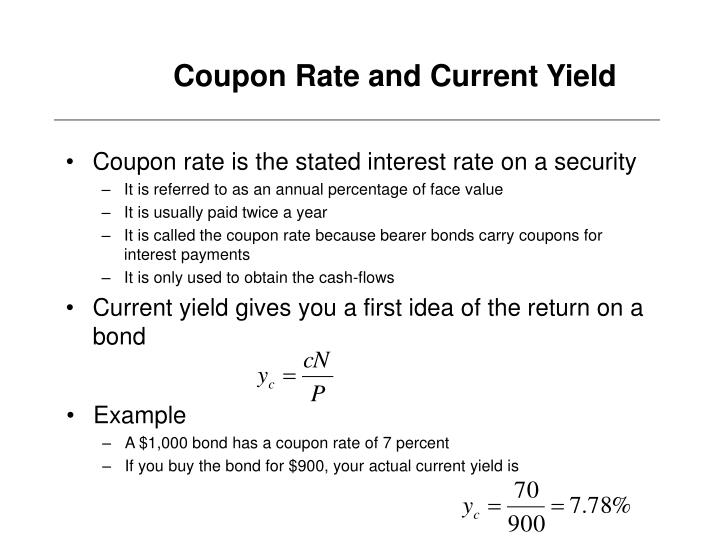

Difference Between Coupon Rate and Yield of Maturity A coupon rate is a rate at which the interest payment of a bond is made to the investor. It represents the yearly interest rate paid by the bond with respect to its face value denoted as a percentage. The coupon rate is like fixed income security for governments in which the issuer of the bond receives the annual interest payments.

Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. ... The interest payment is equivalent to the bond's coupon rate, which is a ...What is the difference between Coupon Rate and interest rate?Which bonds have high Coupon Rates?

If the coupon rate of a bond is equal to its required - Course Hero bond E will have a greater change in price 31) Hewitt Packing Company has an issue of $1,000 par value bonds with a 14 percent annual coupon interest rate. The issue has ten years remaining to the maturity date. Bonds of similar risk are currently selling to yield a12 percent rate of return. The current value of each Hewitt bond is ________.

Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

› coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Solved Which of the following statements is incorrect? a. If - Chegg.com Finance questions and answers. Which of the following statements is incorrect? a. If the coupon rate of a bond s equal to the nvestor's required rate of return, the present value of the bond should be equal to the par value. O b. If the coupon rate of a bond is above the investor's required rate of return, the present value of the bond O c.

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market.

Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Post a Comment for "38 the coupon rate of a bond is equal to"