43 are zero coupon bonds taxable

PDF Income Taxes on Zero Coupon Bonds (Preliminary Version) payments. First the yield needs to be calculated. We will present a simplified three year zero coupon bond as an example. The taxable zero coupon bond is purchased for P = $900 with a value at maturity M = $1000 in three years. Let y = yield so that (1) 900(1 + y)3 = 1000, y = 1 1000 3 900 ªº «»¬¼ - 1 = .0357442 = 3.57442% . Next the (phantom Zero Coupon Bonds- Taxability under Income Tax Act, 1961 The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - "Zero Coupon bond" means a bond: - (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day of June, 2005

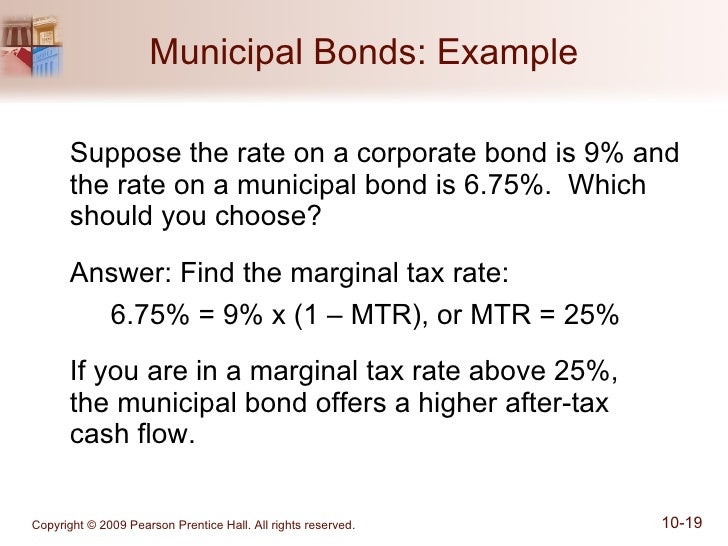

How Are Zero Coupon Bonds Taxed In The Uk? - ictsd.org A zero coupon municipal bond ("a zero") is a zero coupon municipal bond redeemed at a deep discount for a medium- or long-term loan. States which issue zero coupon municipal bonds, the compounded interest is exempt from federal income taxes. If a bond is issued in your state, then you also don't pay state income taxes.

Are zero coupon bonds taxable

Tax on US Treasury STRIPS | Finance - Zacks With a zero coupon Treasury bond, you must pay taxes on the imputed or phantom interest each year. The $100,000 STRIP purchased for $51,400 has a yield to maturity of about 3.3 percent; so in the ... Impact of Taxation on Zero-Coupon Muni Returns Impact of Taxation on Zero-Coupon Munis. Taxation on zero-coupon munis is only realized upon their sale or maturity. If the bond is sold before its maturity, it is either sold at a discount or a premium in the secondary market. Any price paid above the adjusted issue price (discussed below) will be premium and any price below the adjusted issue ... Zero Coupon Municipal Bonds: Tax Treatment - TheStreet , the tax rules for zero-coupon bonds bought as new issues and held to maturity are fairly simple. Whether the bond is taxable or tax exempt, you have to accrue interest on the bond.

Are zero coupon bonds taxable. Investor's Guide to Zero-Coupon Municipal Bonds - Project Invested Zero-coupon municipal bonds combine the benefits of the zero- coupon debt instrument with those of tax-exempt municipal securities. TAX BENEFITS. Because the interest paid by zero-coupon municipal bonds is exempt from federal income taxes, these bonds provide returns that are often higher on an after-tax basis than comparable taxable securities. Tax Considerations for Zero Coupon Bonds - Financial Web Before you can understand the taxes of zero coupon bonds, it helps to have a basic understanding of what this type of bond is. A traditional bond pays you a certain "coupon rate" or interest rate over the life of the bond. Then you get your initial investment back at the end of the investment term. With a zero coupon bond, you are not paid any ... Corporate Bonds India- Invest in Corporate Sector Bonds Bonds having a credit rating of AAA to BBB are considered as Investment Grade Bond , others are considered as Non-investment Grade Bond. Coupon rate : Corporate bonds have higher coupon rates than G-secs. Normally, corporate bonds provide 7%(AAA rated) to 12%(A rated) coupons in the current year 2021. On the contrary, G-secs provide 6% coupon rate. Tax Considerations for Zero Coupon Bonds Tax Considerations. Zero coupon bonds have unique tax implications. Technically, you are earning interest every year, even though you do not see it until the end of the bond term. Therefore, you have to pay the taxes on the interest every single year even though you do not get the interest until the end of the arrangement.

Municipal Bonds vs. Taxable Bonds and CDs - Investopedia Jan 31, 2022 · If you sit in the 35% income tax bracket and live in a state with relatively high income tax rates, investing in municipal bonds (munis, for short) will likely be a better option than taxable ... The Ultimate Guide to Bonds | Bonds | US News May 07, 2020 · Instead, investors buy zero-coupon bonds at a discount to par and then receive the full face value when the bond matures. You might pay $10,000 for a bond that will return $20,000 in 20 years. How are Bonds Taxed Under the Income Tax Act? - Wint Wealth Types of Bonds and Their Taxation . There are different types of bonds in the market. Let us look at their types and taxation. 1. Zero-Coupon Bonds . Zero-coupon bondholders are liable to only capital gain tax as they do not provide any interest income. However, these are issued at a discount. Hence, the difference is taxed as capital gain. 2. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity ...

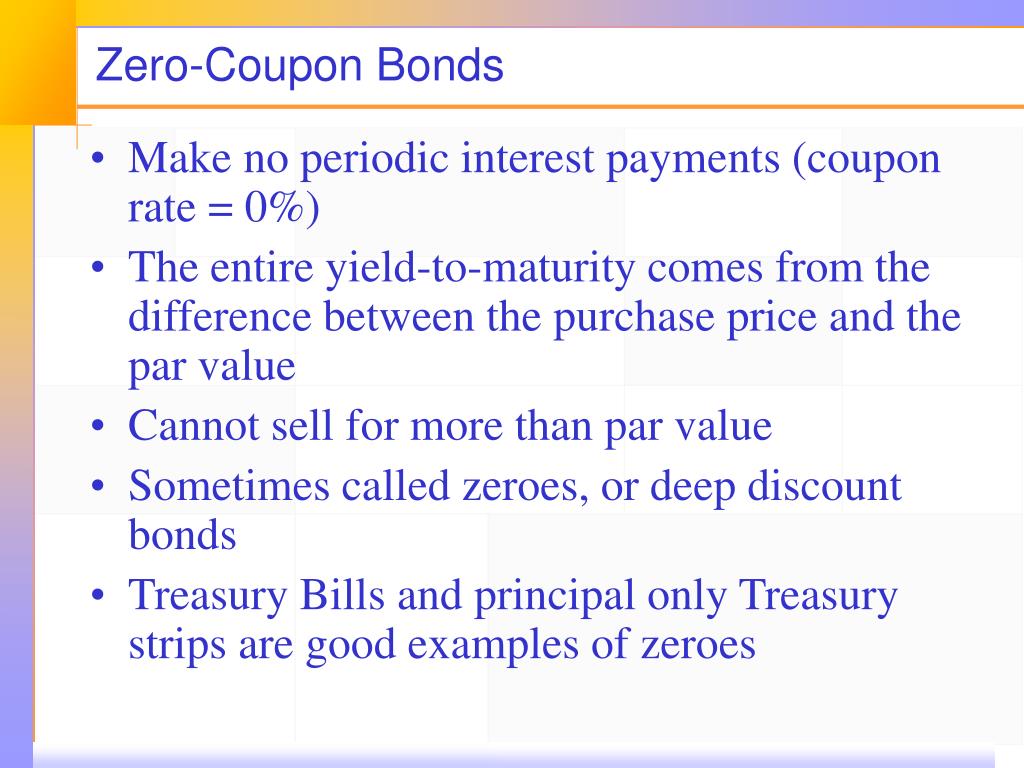

Zero coupon municipal bonds maturation - Intuit The tax rules for zero-coupon bonds bought as new issues and held to maturity are fairly simple. Whether the bond is taxable or tax exempt, you (or your broker) have to accrue interest on the bond. That means you have to calculate the portion of the difference between the purchase price and face value that accrued to you. $500 x 0.0705 = $35.25 ... Understanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity. Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Zero coupon bonds that are notified and issued by REC and NABARD are taxable. Earnings from zero coupon bonds are also subject to capital gains tax at the time of maturity. The earnings or capital appreciation for zero coupon bonds is the difference between the maturity value and purchase price of the bond. Zero Coupon Bonds | Tamar Securities Financial Por Taxable Bonds Zero-Coupon Bonds. Zero-coupon bonds are issued at a discount to face value and gradually accrue value to maturity. Zero-coupon bonds do not pay regular interest payments and mature at par ($1,000) for one lump sum payment. Corporations, municipalities, and the US Treasury issue zero-coupon bonds. Even though investors do not ...

How Are Municipal Bonds Taxed? - Investopedia Jan 17, 2022 · However, most zero-coupon municipal bonds are sold in denominations of $5,000. Either way, you’re buying at a tremendous discount. This, in turn, allows you to buy more bonds if you so desire.

Publication 1212 (01/2022), Guide to Original Issue Discount (OID ... It discusses the income tax rules for figuring and reporting OID on long-term debt instruments. It also includes a similar discussion for stripped bonds and coupons, such as zero coupon bonds available through the Department of the Treasury's STRIPS program and government-sponsored enterprises such as the Resolution Funding Corporation.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. ... state, and local income tax on the imputed or "phantom" interest that accrues each year ...

Taxation Rules for Bond Investors--A Taxing Issue Taxation of Zero-Coupon Bonds . ... The interest from these bonds is tax free at the federal, state and local levels, as long as investors reside in the same state or municipality as the issuers.

Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips Note: Muni bonds exempt from federal, state, and local taxes are known as "triple tax exempt." Zero-coupon bonds. Zero-coupon bonds are a special case. You might have to pay tax on their interest ...

Zero-Coupon Bonds - Tax Professionals Member Article By Carmen Garcia Zero-Coupon Bonds. A zero-coupon bond is a type of bond that earns no interest during its lifetime. A zero-coupon bond is issued with a sudden reduction in par value or face value, which is the amount that will be paid for the bond at maturity. An investor receives a one-time interest payment at maturity equal to the difference between the face ...

How is tax calculated on a zero coupon bond? - Quora Answer (1 of 5): Great question. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount a bond will be worth when it "matures" or comes due. When a zero coupon bond ...

Do you pay taxes on zero coupon bonds? - Quora Answer: Yes. When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. For example, suppose you were currently aged 58 and earning enough money to be ...

Post a Comment for "43 are zero coupon bonds taxable"