38 what coupon rate should the company set on its new bonds if it wants them to sell at par

7.6-7.7 Bonds: Inflation, Interest Rates,and Determinants of ... - Quizlet The company currently has 11.6 percent coupon semiannual payments, and mature in 14 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Will be on exam. If Connor Co. wants the bonds to sell at par, they should set the coupon rate equal to the required return. Business Finance Ch6 Quiz - Connect Flashcards | Quizlet Business Finance Ch6 Quiz - Connect. Union Local School District has bonds outstanding with a coupon rate of 3.3 percent paid semiannually and 20 years to maturity. The yield to maturity on these bonds is 3.7 percent and the bonds have a par value of $10,000. What is the price of the bonds?

What coupon rate should be applied to the new bonds if VVI wants to ... View What coupon rate should be applied to the new bonds if VVI wants to sell them at par.docx from BUS 475 at Strayer University, Memphis. What coupon rate should be applied to the new bonds if VVI. Study Resources. Main Menu; by School; ... What recommendations would you make in improving the financial prospect of the company especially with ...

What coupon rate should the company set on its new bonds if it wants them to sell at par

Tan- 6 Flashcards - Quizlet LKM, Inc. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6.5 percent coupon bonds on the market that sell for $972.78, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? TUTORIAL BOND VALUATION.docx - TUTORIAL: BOND VALUATION Question 1 ... View TUTORIAL BOND VALUATION.docx from FINANCE MISC at INTI International University. TUTORIAL: BOND VALUATION Question 1 Mascara Inc. wants to issue new 30-year bonds for some much-needed expansion Finance 300 Exam 2 Flashcards - Quizlet Bonner Metals wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 8.5 percent bonds on the market that sell for $959, make semiannual payments, and mature in 16 years. What should the coupon rate be on the new bonds if the firm wants to sell them at par? A) 8.75 percent B) 9.23 percent C) 8.41 percent

What coupon rate should the company set on its new bonds if it wants them to sell at par. Solved Uliana Company wants to issue new 20-year bonds for - Chegg What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round; Question: Uliana Company wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6 percent coupon bonds on the market with a par value of $1,000 that sell for $967, make semiannual payments, and ... FIN401 Exam 2 (Chapter 7) Flashcards - Quizlet Pembroke Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 10% coupon bonds on the market that sells for $1,063, makes semiannual payments and matures in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Solved BDJ Co. wants to issue new 21-year bonds for some | Chegg.com Answer to Solved BDJ Co. wants to issue new 21-year bonds for some Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Uliana Company wants to issue new 21-year bonds for | Chegg.com Uliana Company wants to issue new 21-year bonds for some much-needed expansion projects. The company currently has 9.6 percent coupon bonds on the market that sell for $1,136, make semiannual payments, have a par value of $1,000, and mature in 21 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Uliana Co. wants to issue new 20-year bonds for some much needed Need more help! Uliana Co. wants to issue new 20-year bonds for some much needed expansion projects. The company currently has 6 percent coupon bonds on the market with a par value of $1,000 that sell for $967, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? FIN Flashcards - Quizlet West Corp. issued 18-year bonds 2 years ago at a coupon rate of 9.6 percent. The bonds make semiannual payments. If these bonds currently sell for 101 percent of par value, what is the YTM? ... Duncan Brooks, Co., needs to borrow $500,000 to open new stores. Brooks can borrow$500,000 by issuing 5%, 10-year bonds at a price of 96. What Coupon Rate Should The Company Set On Its New Bonds If It Wants ... A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years. The bonds make semiannual payments and currently sell for 104 percent of par.

Solved Uliana Company wants to issue new 18-year bonds for | Chegg.com The company currently has 9 percent coupon bonds on the market that sell for $1,045, have a par value of $1,000, make semiannual payments, and mature in 18 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Question: Uliana Company wants to issue new 18-year bonds for some much-needed expansion ... Finance Midterm 1 Flashcards - Quizlet LKM, Inc. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6.5 percent coupon bonds on the market that sell for $972.78, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Solved Uliana Company wants to issue new 15-year bonds for | Chegg.com What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and; Question: Uliana Company wants to issue new 15-year bonds for some much-needed expansion projects. The company currently has 9 percent coupon bonds on the market that sell for $1,070, make semiannual payments ... What coupon rate should the company set on its new bonds if it wants ... What coupon rate should the company set on its new bonds if it wants them to from FINA 6320 at University of Texas, Permian Basin. Study Resources. Main Menu; by School; by Literature Title; ... What coupon rate should the company set on its new. School University of Texas, Permian Basin; Course Title FINA 6320;

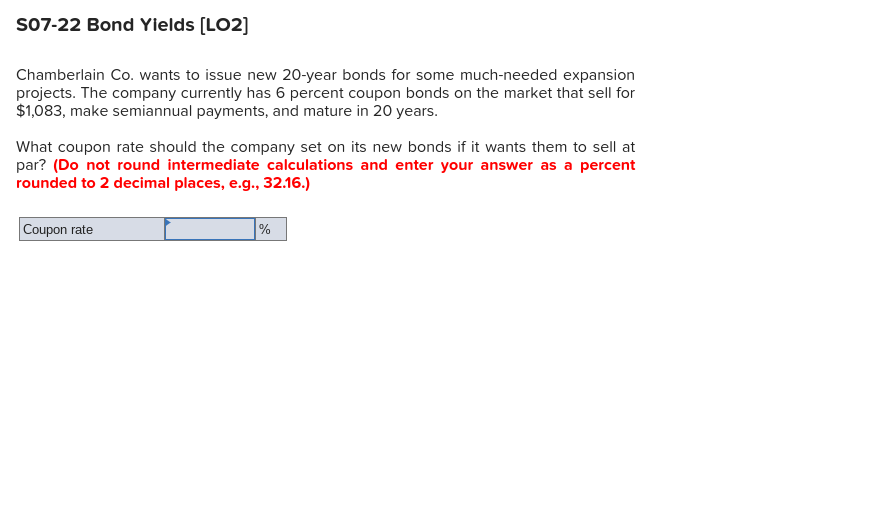

(Get Answer) - What coupon rate should the company set on its new bonds ... What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Solved What coupon rate should the company set on its new | Chegg.com Calculation of The YTM of the Bond: Given: Face Value (FV) = $1000 Current Market Value (MV) = $1125 Coupon rate = 5.8% or 0.058 No. of years = 10 years Coupon payment frequency in a year = 2 times Interest compounding frequency in a year = 2 times B… View the full answer

BDJ Co. wants to issue new 25-year bonds for some much ... - Brainly.com The company currently has 4.8 percent coupon bonds on the market that - 137359… bellapearl7794 ... will give you a coupon of 25.40 hence the yield and coupon rate has to be same for the bond issued to be sold at the par value. Coupon Rate = Market yield = 5.07%. Advertisement Advertisement ... A company wants to estimate, at a 95% confidence ...

Bond Yields: Uliana Co. wants to issue new 20-year bonds ... - Brainly.com Bond Yields: Uliana Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6% coupon bonds on the market with a par value of $1,000 that sell for $967, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par

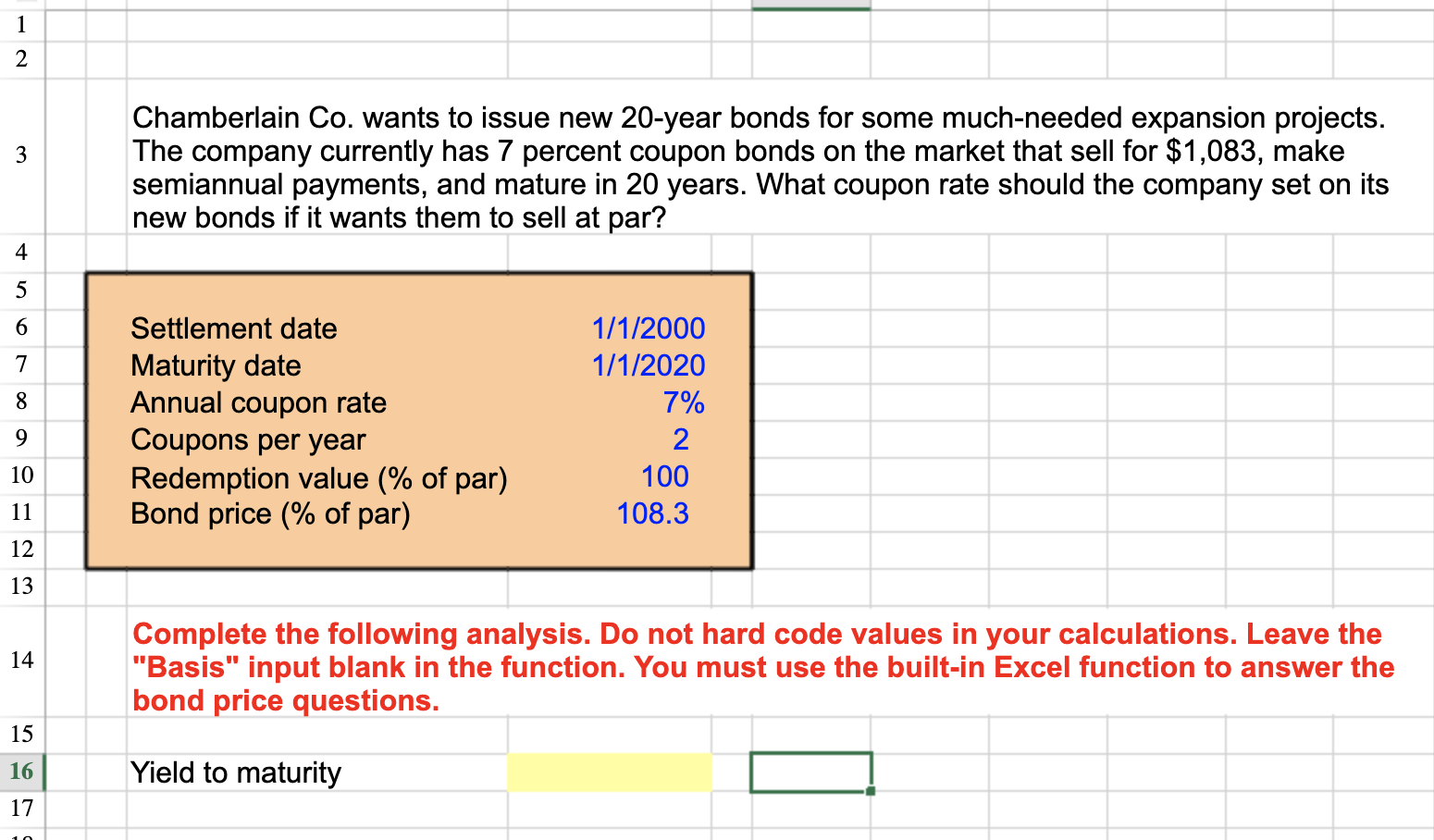

Bonds_2-Fina201.docx - Introduction: Exercise 3: Even... The bonds make semiannual payments and currently sell for 106.8 percent of par. ... wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new ...

Answer in Finance for rim #9185 - Assignment Expert LKM, Inc. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6.5 percent coupon bonds on the market that sell for $972.78, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? 6.25 percent 6.37 percent 6.50 percent

Post a Comment for "38 what coupon rate should the company set on its new bonds if it wants them to sell at par"