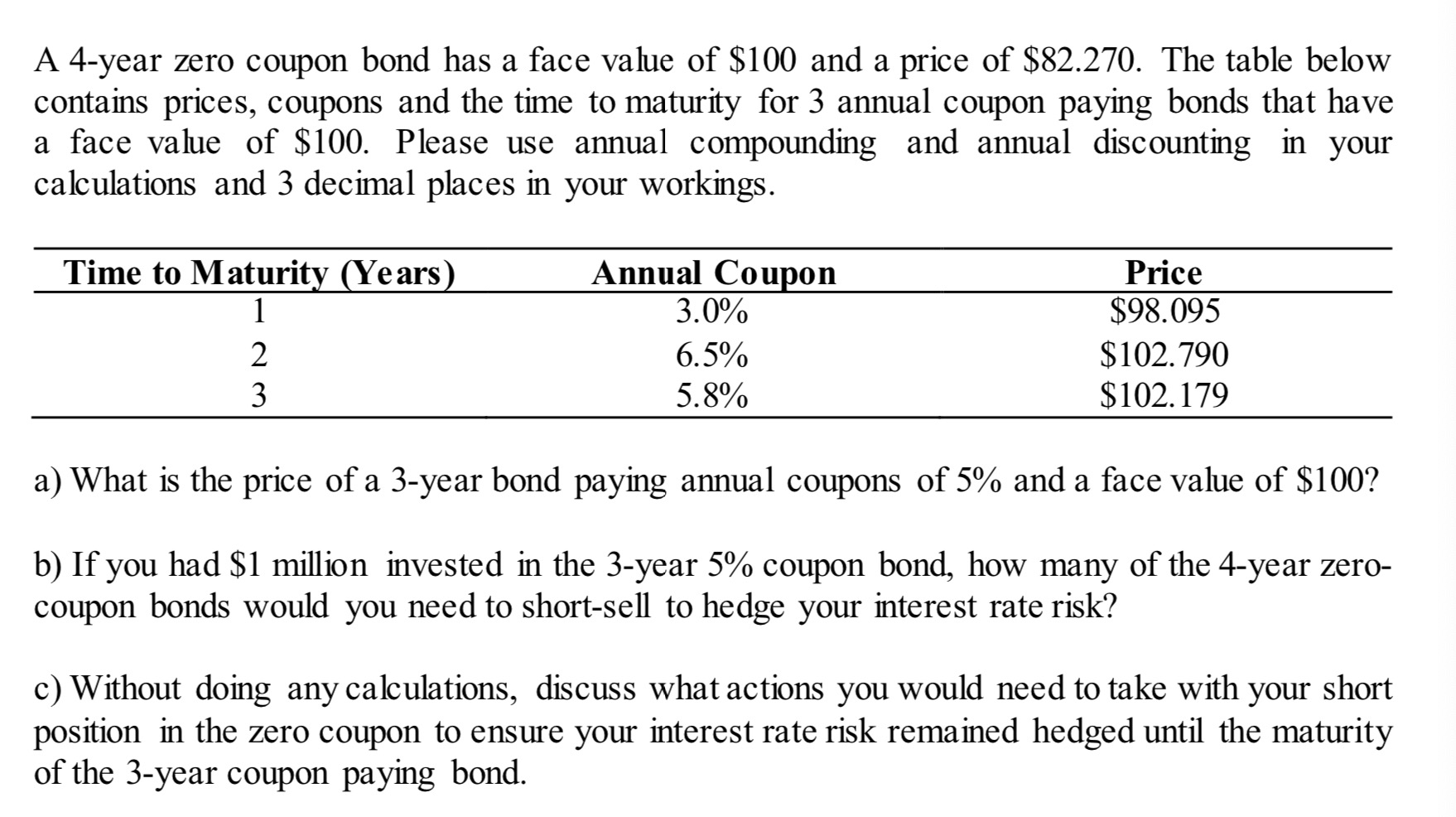

43 price of coupon bond

en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia The terms of the bond, such as the coupon, are fixed in advance and the price is determined by the market. In the case of an underwritten bond, the underwriters will charge a fee for underwriting. An alternative process for bond issuance, which is commonly used for smaller issues and avoids this cost, is the private placement bond. › terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

Price of coupon bond

Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ... Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

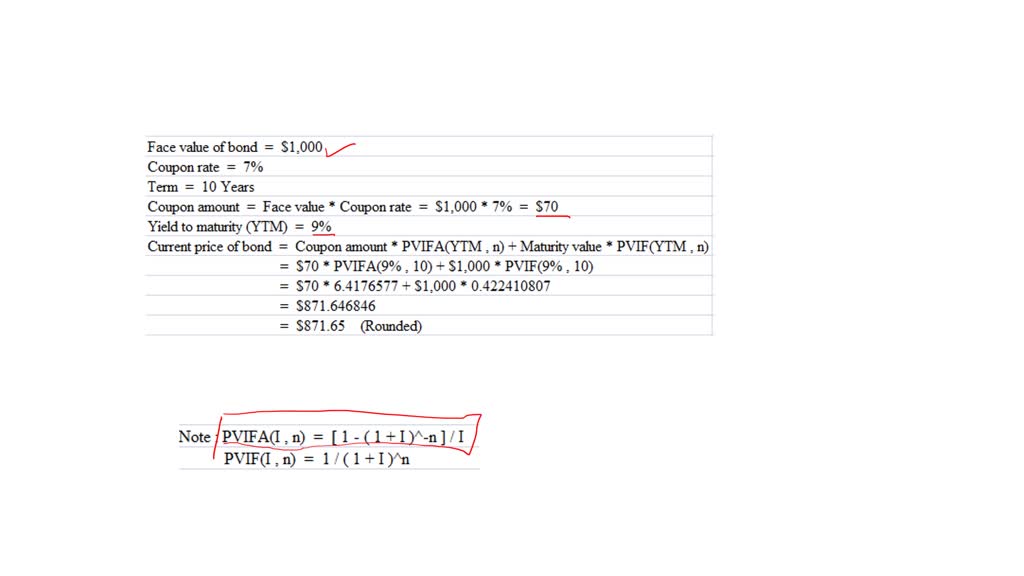

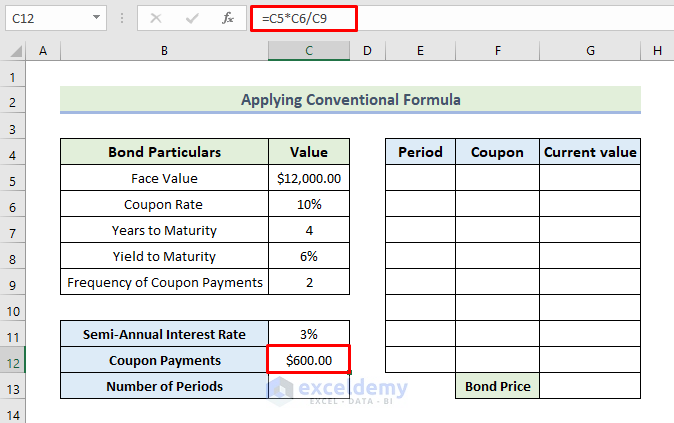

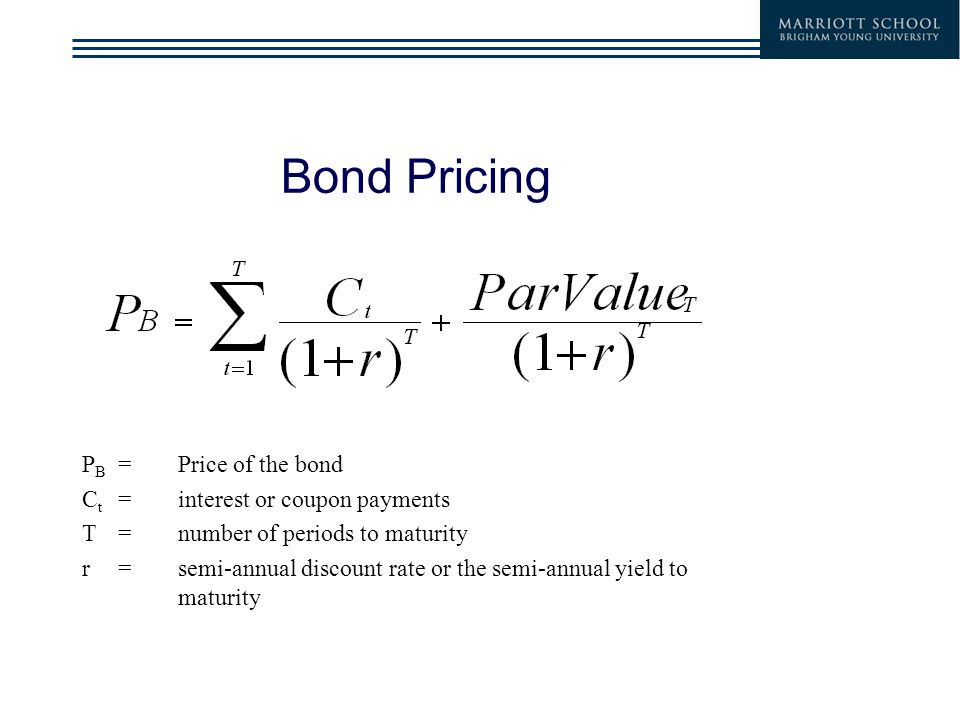

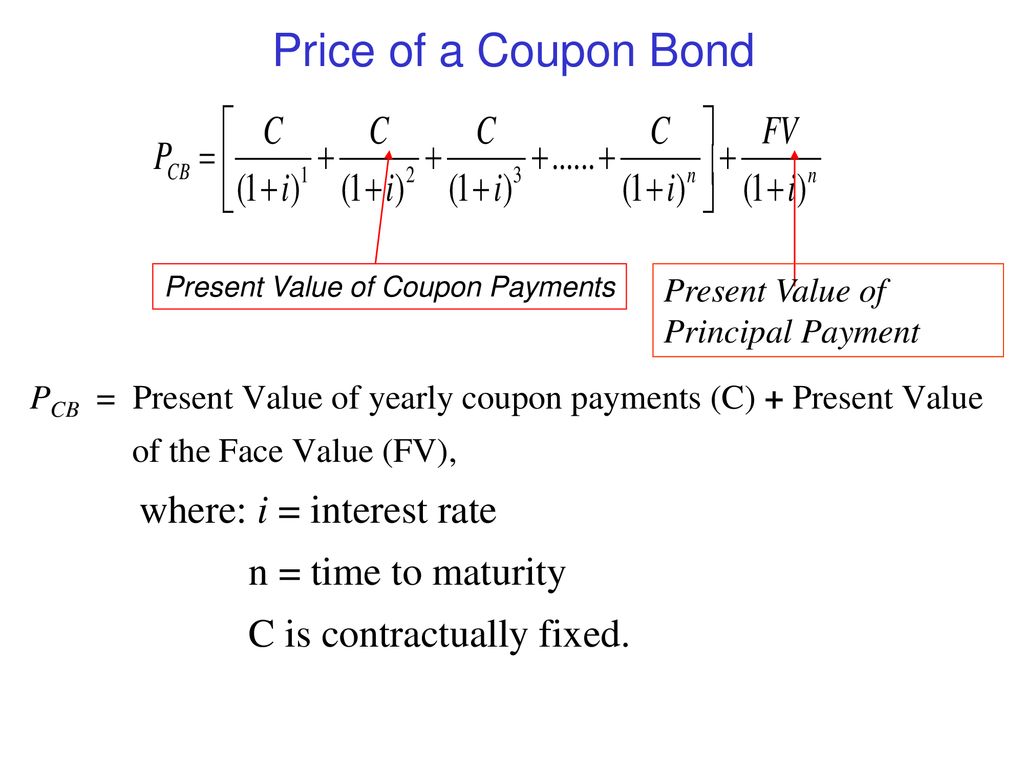

Price of coupon bond. Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. › terms › zZero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... How to Calculate Bond Price in Excel (4 Simple Ways) The typical Coupon Bond Price formula is 🔄 Coupon Bond Price Calculation As mentioned earlier, you can calculate the bond price using the conventional formula. Use the below formula in the C11 cell to find the Coupon Bond price. =C10* (1- (1+ (C8 /C7))^ (-C7*C6 ))/ (C8/C7)+ (C5/ (1 + (C8/C7))^ (C7*C6)) Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The price of each bond is calculated using the below formula as, Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM.

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon bond = $40* [ (1- (1+7%/2))^ (-12)) / (7%/2) ] + [$1,000/ (1+7%/2)^12] Coupon Bond = $951.68 Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market. Bond (finance) - Wikipedia The terms of the bond, such as the coupon, are fixed in advance and the price is determined by the market. In the case of an underwritten bond, the underwriters will charge a fee for underwriting. An alternative process for bond issuance, which is commonly used for smaller issues and avoids this cost, is the private placement bond. Coupon Bond - Guide, Examples, How Coupon Bonds Work Despite the bond's relatively simple design, its pricing remains a crucial issue. If there is a high probability of default, investors may require a higher rate of return on the bond. Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate Bond Price Calculator | Formula | Chart Jun 20, 2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life.You can see how it changes over time in the bond price chart in our calculator. To use bond price equation, you need to input the …

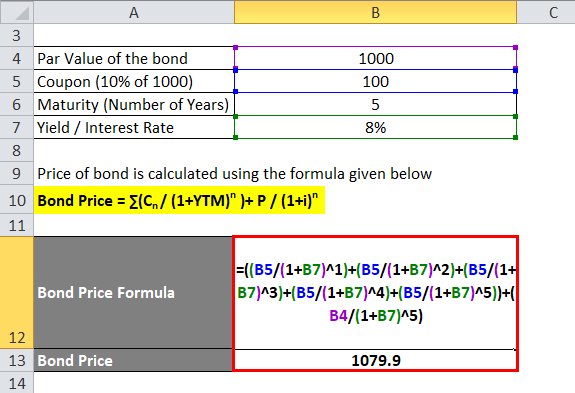

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Price of Bond (PV) = $742.47 We can enter the inputs into the YTM formula since we already have the necessary inputs: Semi-Annual Yield-to-Maturity (YTM) = ($1,000 / $742.47) ^ (1 / 10 * 2) - 1 = 1.5% Annual Yield-to-Maturity (YTM) = 1.5% * 2 = 3.0% Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond... Bond Pricing Formula |How to Calculate Bond Price? - EDUCBA Bond Price = 92.6 + 85.7 + 79.4 + 73.5 + 68.02 + 680.58; Bond Price = Rs 1079.9; Bond Pricing Formula – Example #2. Let’s calculate the price of a Reliance corporate bond which has a par value of Rs 1000 and coupon payment is 5% … Zero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

› ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ...

Bond Prices, Rates, and Yields - Fidelity The prevailing interest rate is the same as the bond's coupon rate. The price of the bond is 100, meaning that buyers are willing to pay you the full $20,000 for your bond. 2. Prevailing interest rates rise to 7%. Buyers can get around 7% on new bonds, so they'll only be willing to buy your bond at a discount. In this example, the price drops ...

Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? 5*2 = $781.20. The price that John will pay ...

Bond duration - Wikipedia The zero-coupon bond will have the highest sensitivity, changing at a rate of 9.76% per 100bp change in yield. This means that if yields go up from 5% to 5.01% (a rise of 1bp) the price should fall by roughly 0.0976% or a change in price from $61.0271 per $100 notional to roughly $60.968. ... This bond's price sensitivity to interest rate ...

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Bond Pricing Formula | How to Calculate Bond Price? | Examples Bond price = $104,158.30 Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium Example #3 Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years.

› articles › bondsUnderstanding Bond Prices and Yields - Investopedia Although a bond's coupon rate is fixed, the price of a bond sold in secondary markets can fluctuate. As the price of a bond increases or decreases, the true yield will change—straying from the...

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

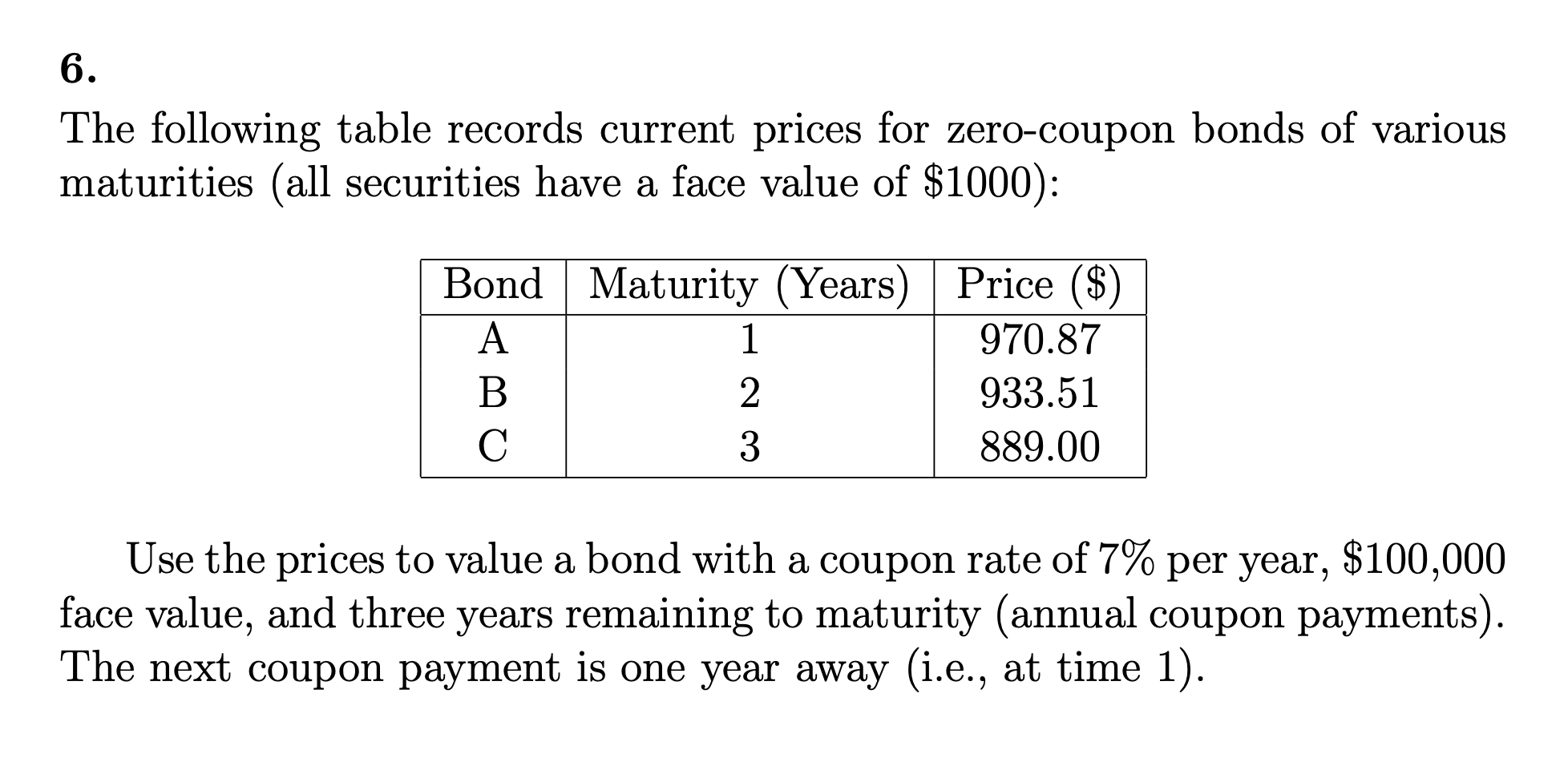

› bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay ...

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508)

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

en.wikipedia.org › wiki › Bond_durationBond duration - Wikipedia The zero-coupon bond will have the highest sensitivity, changing at a rate of 9.76% per 100bp change in yield. ... This bond's price sensitivity to interest rate ...

Chapter 4 - Valuation and Bond Analysis - Business Finance Essentials The current price of a 4.25% coupon bond with 10 years to maturity is $918.23, what is the YTM? Problem 3. The current price of a 9.75% coupon bond with 20 years to maturity is $1318, what is the YTM? If the bond contains a call provision that allows the company to call the bond for $1050 7-years from now, what is the YTC?

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond.

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $25 * [1 - (1 + 4.5%/2)-16] + [$1000 / (1 + 4.5%/2) 16; Coupon Bond = $1,033; Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation. The formula for coupon bond can be derived by using the following steps:

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ...

bond prices wms inc has 7 percent coupon bonds on the market that have 10 years left to maturity the bonds make annual payments if the ytm on these bonds is 9 percent what is the current bond price

Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Post a Comment for "43 price of coupon bond"