41 yield to maturity of a coupon bond formula

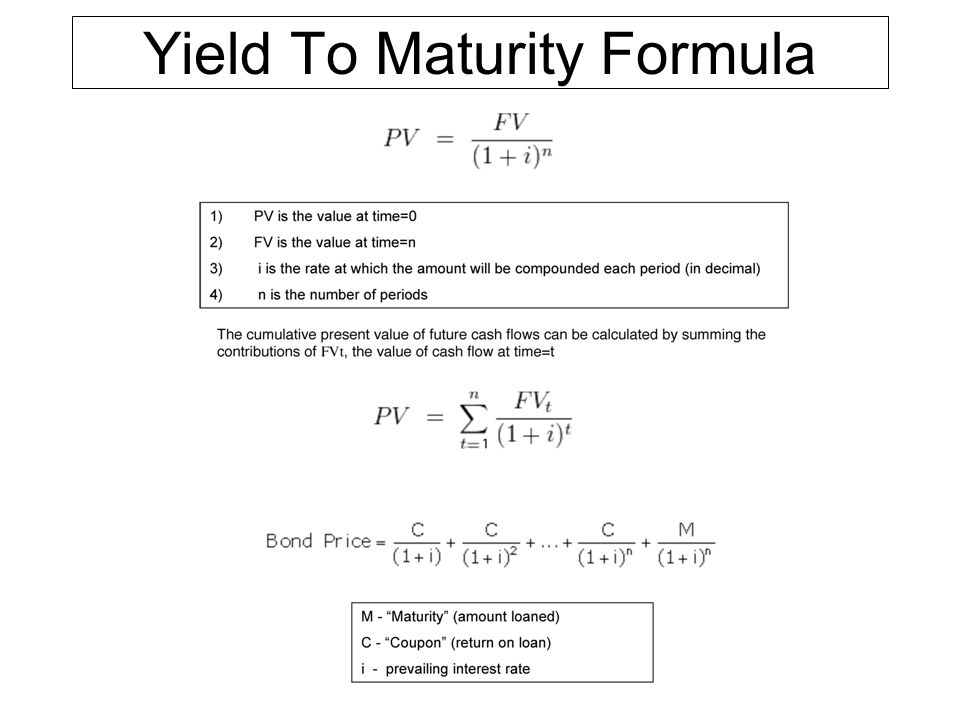

Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ... Bond Yield to Maturity (YTM) Calculator - DQYDJ WebEstimated Yield to Maturity Formula. However, that doesn't mean we can't estimate and come close. The formula for the approximate yield to maturity on a bond is: ( (Annual Interest Payment) + ( (Face Value - Current Price) / (Years to Maturity) ) ) / ( ( Face Value + Current Price ) / 2 ) Let's solve that for the problem we pose by default in ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond Web10.10.2022 · Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the return of ...

Yield to maturity of a coupon bond formula

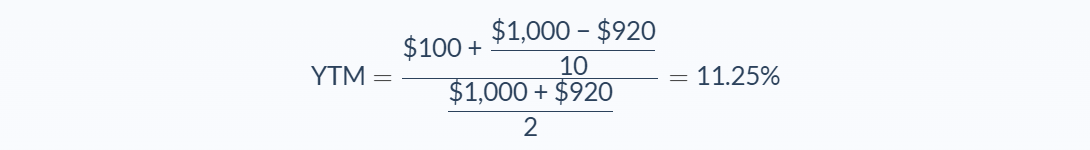

Yield to Maturity - Approximate Formula (with Calculator) The price of a bond is $920 with a face value of $1000 which is the face value of many bonds. Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be. After solving this equation, the estimated yield to maturity is 11.25%. Yield to Maturity (YTM) - Overview, Formula, and Importance Oct 26, 2022 · How YTM is Calculated YTM is typically expressed as an annual percentage rate (APR). It is determined through the use of the following formula: Where: C – Interest/coupon payment FV – Face value of the security PV – Present value/price of the security t – How many years it takes the security to reach maturity Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/(1+YTM)^1 + 40/(1+YTM)^2 + 1000/(1+YTM)^2. The Yield to Maturity (YTM) of the bond is 24.781%. After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

Yield to maturity of a coupon bond formula. Bond Yield: Formula and Percent Return Calculation - Wall Street … WebCalculating the current yield of a bond is a three-step process: Step 1: The current bond price can be readily observed in the markets – in which the bond can either trade at a discount, at par or at a premium to par.; Step 2: The annual coupon is a function of the bond’s coupon rate, par value, and payment frequency – and, if applicable, the coupon … Yield to Maturity (YTM) - Meaning, Formula and Examples - Groww Current yield, by definition, is the annual rate of return that you receive for the price paid for that bond. The formula of current yield: Coupon rate / Purchase price. Naturally, if the bond purchase price is equal to the face value, the current yield will be equal to the coupon rate. Current Yield = 160/2,000 = 0.08 or 8%. Yield to Maturity Formula & Examples | How to Calculate YTM - Video ... There are various styles of calculating investment returns using a yield to maturity formula. ... Here is an example of a $100 zero-coupon bond with a two-year maturity date, and the current value ... Yield to Maturity (YTM) Approximation Formula - Finance Train P = Bond Price. C = the semi-annual coupon interest. N = number of semi-annual periods left to maturity. Let's take an example to understand how to use the formula. Let us find the yield-to-maturity of a 5 year 6% coupon bond that is currently priced at $850. The calculation of YTM is shown below: Note that the actual YTM in this example is 9 ...

Understanding the Yield to Maturity (YTM) Formula | SoFi Sep 14, 2021 · Here’s an example of how to use the YTM formula. Suppose there’s a bond with a market price of $800, a face value of $1,000, and a coupon value of $150. The bond will reach maturity in 10 years, with a coupon rate of about 14%. By using this formula, the estimated yield to maturity would calculate as follows: Yield to Maturity (YTM) - Definition, Formula, Calculation Examples YTM considers the effective yieldEffective YieldEffective yield is a yearly rate of return at a periodic interest rate proclaimed to be one of the effective measures of an equity holder's return as it takes compounding into its due consideration, unlike the nominal yield method.read more of the bond, which is based on compoundingCompoundingCompound... Bond Yield Calculator – Compute the Current Yield - DQYDJ WebEnter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield. The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formula. Bond Yield Calculator. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? What is Coupon Bond Formula? The term " coupon bond Coupon Bond Coupon bonds pay fixed interest at a predetermined frequency from the bond's issue date to the bond's maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate. read more " refers to bonds that pay coupons which is a nominal percentage of the par value or ...

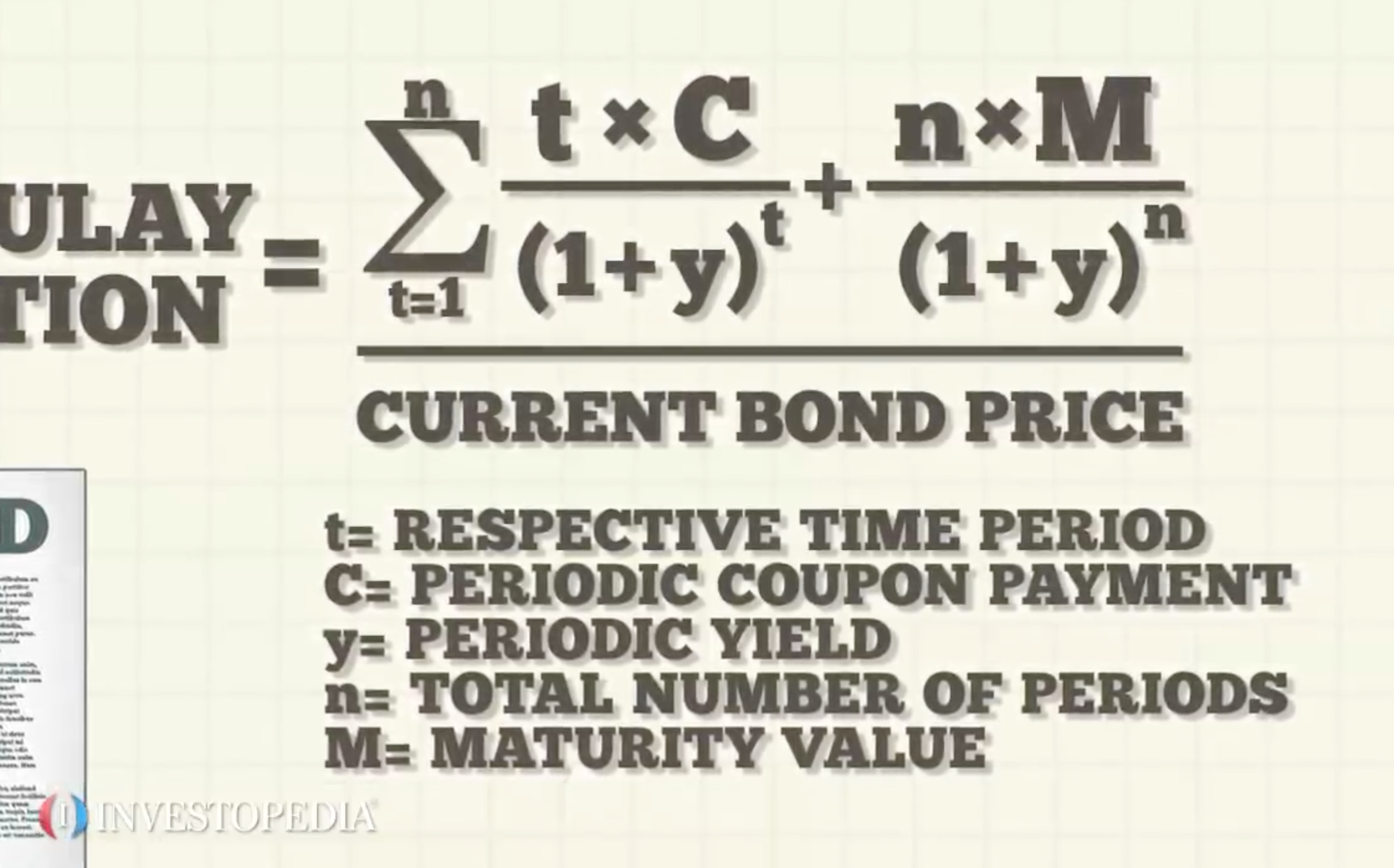

Yield to Maturity (YTM): What It Is, Why It Matters, Formula Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield but is expressed as an annual rate. In other words, it is the internal rate of return (IRR) of an investment in a bond if the investor holds the bond until maturity, with all payments made as scheduled and reinvested at the same rate. Yield to maturity - Wikipedia WebThe yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the … Yield to Maturity (YTM): Formula and Bond Calculation - Wall … What is Yield to Maturity? The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then ... Coupon Bond Formula | Examples with Excel Template - EDUCBA t = Number of Years Until Maturity; Examples of Coupon Bond Formula (With Excel Template) ... In this case, the coupon rate is 5% but to be paid semi-annually, while the yield to maturity is currently at 4.5%. Two years have passed since bond issuance and as such there are 8 years left until maturity. Calculate the market price of the bonds ...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter WebUse Zero Coupon Bond Calculator to calculate your Maturity Value in 2022. This Zero Coupon Bond Calculator can help you check your rate of change, percentage increase ... so for that, and there is a particular formula in terms of economics that helps us to calculate that yield. The formula is mentioned below: Zero-Coupon Bond Yield = F ...

Yield to Maturity Calculator | Calculate YTM Yield to maturity calculator: how to find YTM and the YTM formula. The YTM formula needs 5 inputs: bond price - Price of the bond; face value - Face value of the bond; coupon rate - Annual coupon rate; frequency - Number of times the coupon is distributed in a year; and. n - Years to maturity.

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/(1+YTM)^1 + 40/(1+YTM)^2 + 1000/(1+YTM)^2. The Yield to Maturity (YTM) of the bond is 24.781%. After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

Yield to Maturity (YTM) - Overview, Formula, and Importance Oct 26, 2022 · How YTM is Calculated YTM is typically expressed as an annual percentage rate (APR). It is determined through the use of the following formula: Where: C – Interest/coupon payment FV – Face value of the security PV – Present value/price of the security t – How many years it takes the security to reach maturity

Yield to Maturity - Approximate Formula (with Calculator) The price of a bond is $920 with a face value of $1000 which is the face value of many bonds. Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be. After solving this equation, the estimated yield to maturity is 11.25%.

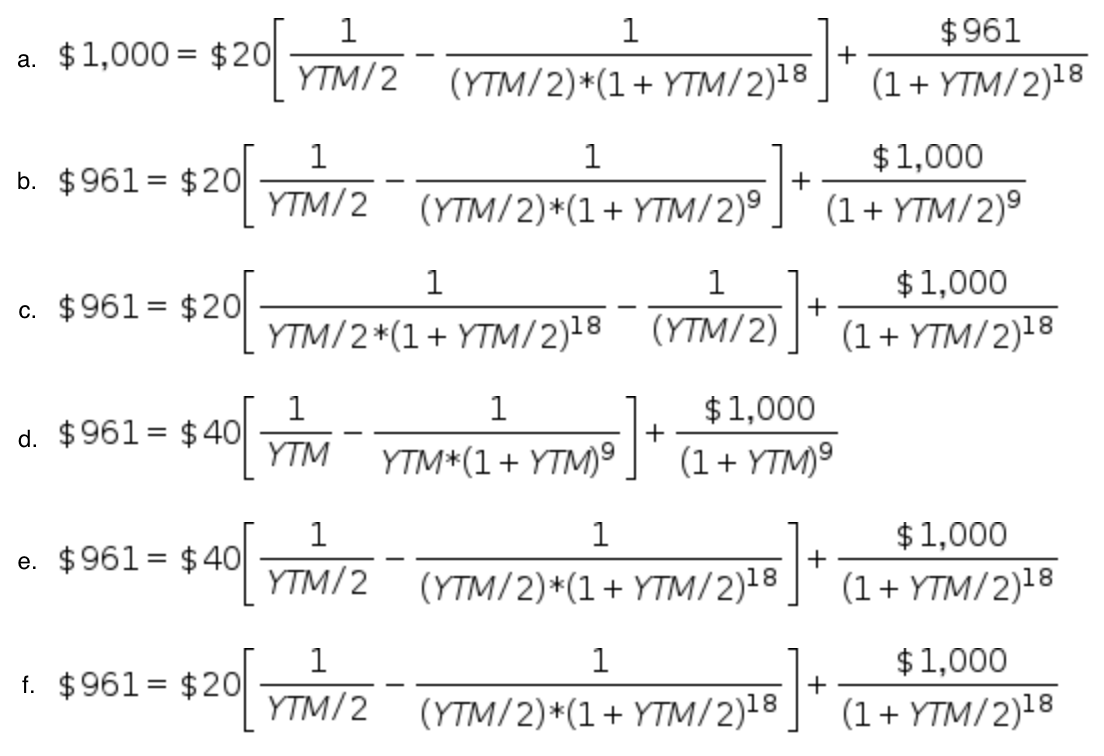

Write down the formula that is used to calculate the yield to maturity on a twenty-year 12 % coupon bond with a 1,000 face value that sells for 2,500.

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Post a Comment for "41 yield to maturity of a coupon bond formula"