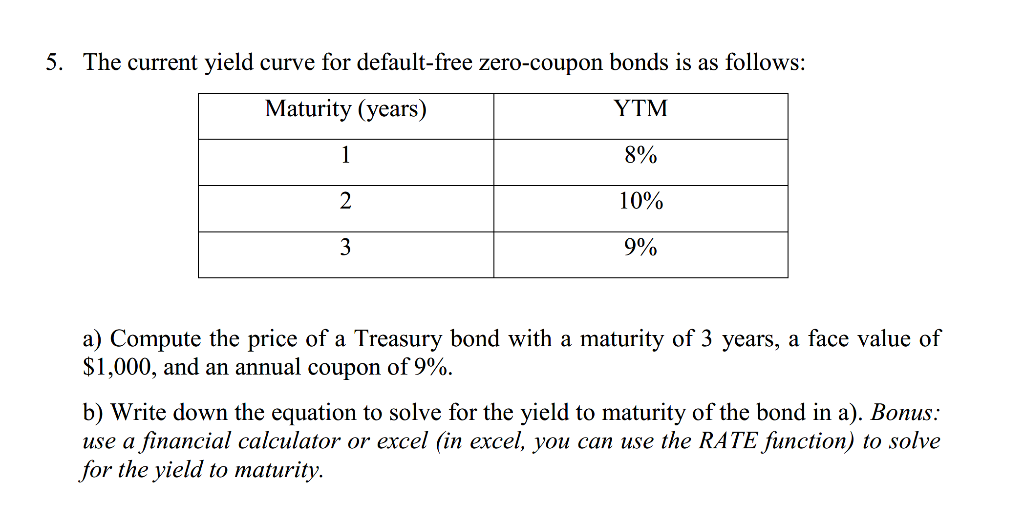

42 valuing zero coupon bonds

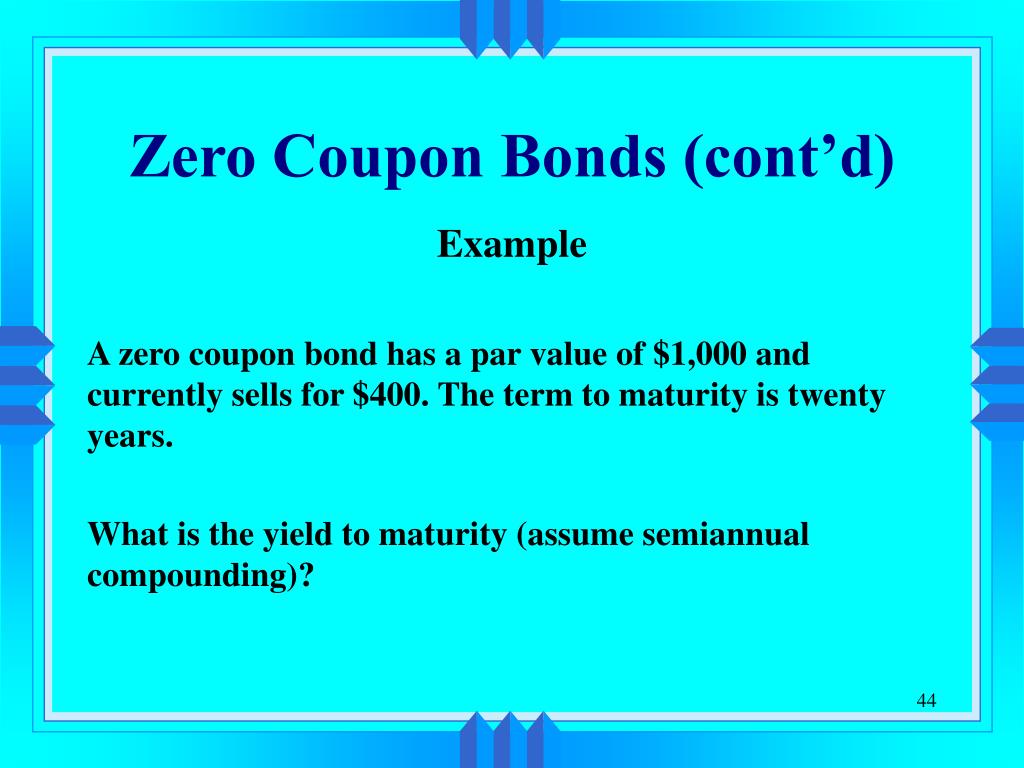

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000... Zero - Coupon Bonds - Economy Blatt The yield to maturity of a zero - coupon bond is the return an investor can earn from holding the bond to maturity and receiving the promised face value payment. We can determine the yield to maturity of the one - year zero - coupon bond discussed above. 144,927 = 150,000 / (1+ YTM 1) 1 + YTM 1 = 150,000 / 144, 927 1+ YTM 1 = 1.035 YTM 1 = 3.5%

Answered: Your Aunt Betty has a $120,000… | bartleby Assume you are treasury manager in a company and the company requires $1,000,000 ($1 Million) in 6 months for the duration of 1 year. You can finance this need by trading zero-coupon bonds, i.e., buying or selling zero-coupon bonds or go to bank to organize a forward contract.

Valuing zero coupon bonds

Pricing of Swaps, Futures, & Forward Contracts | CFA Institute With a basic understanding of pricing and valuing a simple interest rate swap, it is a straightforward extension to pricing and valuing currency swaps and equity swaps. The solution for each of the three variables, one notional amount (NA a ) and two fixed rates (one for each currency, a and b), needed to price a fixed-for-fixed currency swap are : Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Valuing zero coupon bonds. Valuing a zero-coupon bond | Mastering Python for Finance - Packt Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, y is the annually-compounded yield or rate of the bond, and t is the time remaining to the maturity of the bond. Let's take a look at an example of a five-year zero-coupon bond with a face value of $ 100. The yield is 5%, compounded annually. Net Asset Value (NAV): Formula and NAV Per Share Calculation Net Asset Value (NAV) and Mutual Funds. The net asset value (NAV) commonly appears in the context of mutual funds, as the metric serves as the basis for setting the mutual fund share price.. NAV on a per-unit basis represents the price at which units (i.e. ownership shares) in the mutual fund can be purchased or redeemed, which is typically done at the end of each trading day. Valuing Bonds | Boundless Accounting | | Course Hero zero-coupon bond: A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. "Beat Back the Hun with Liberty Bonds" : After war was declared, the moral imperative of liberty and the Allied cause was touted in official ... Zero Coupon Bond Value Formula - Crunch Numbers Price of the zero-coupon bond is calculated much easier than a coupon bond price since there are no coupon payments. It is calculated as: P = \frac {M} { (1 + r)^ {n}} P = (1+r)nM. Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is the number of years until maturity.

How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ... All the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Solved 2. Valuing a Zero-Coupon Bond. Assume the following | Chegg.com Question: 2. Valuing a Zero-Coupon Bond. Assume the following information for existing zero-coupon bonds: Par value = $100,000 Maturity = 3 years Required rate of return by investors = 12% How much should investors be willing to pay for these bonds? ANSWER: PV of Bond = PV of Coupon Payments + PV of Principal $0 + 100,000 (PVIF-12% -3 ... Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... The price of zero-coupon bonds is calculated using the formula given below: See also How do you know if a stock will split? (Explained) Price = M / (1 + r) ^ n, where M = maturity value of the bond. (In other words, the face value of the bond) R = required rate of return (or interest rate) N = number of years till maturity

What are bond spreads? - Financial Pipeline 19.02.2016 · For example, an investor can buy Province of Ontario “zero coupon” bonds for the same maturity date in three different forms: 1) a “coupon” which is a stripped coupon payment from an Ontario bond; 2) a “residual” which is the stripped principal payment from an Ontario bond; and 3) an actual zero-coupon Ontario Global bond issue which was originally issued as … Zero Coupon Bond - Explained - The Business Professor, LLC 17 Apr 2022 — The trading value goes up as the bond approaches its priority date. The priority date is the date on which the bonds face value will be payable. Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The zero-coupon bond value refers to the current value of a zero-coupon bond. This formula requires three variables: face value, interest rate and the number of years to maturity. The zero-coupon bond value is usually expressed as a monetary amount. This equation is sensitive to interest rate fluctuations. Valuation Of Zero Coupon Bond And Handling Semi Annual Compounding ... Date value 1 is calculate the zero zero bond- 3- or face a face to number maturity price maturity coupon r interest its the formula bond of rate the value deter. Home; News; Technology. All; Coding; Hosting; Create Device Mockups in Browser with DeviceMock. Creating A Local Server From A Public Address.

What are bond spreads? - Financial Pipeline Feb 19, 2016 · The yield spread or “curve spread ” between these two bonds is 1.6%, which reflects the interest rate between the two bonds and the conditions of monetary policy. Coupon Spreads are spreads that reflect the differences between bonds with different interest rate coupons. For example, the Government of Canada has issued two bonds that are due ...

SOPHIA PATHWAYS Principles of Finance unit 2 - Quizlet Study with Quizlet and memorize flashcards containing terms like In relation to the time value of money, what is interest? d.)The cost of not having money today, In relation to the time value of money, what is discounting? b.)The process of determining the present worth of money that will be paid or received in the future, The time value of money says that money today is worth …

Valuing a zero-coupon bond | Mastering Python for Finance - Packt Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, is the annually compounded yield or rate of the bond, and is the time remaining to the maturity of the bond. Let's take a look at an example of a 5-year zero-coupon bond with a face value of $100. The yield is 5 percent, compounded annually.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ...

Zero Coupon Bond | Investor.gov Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

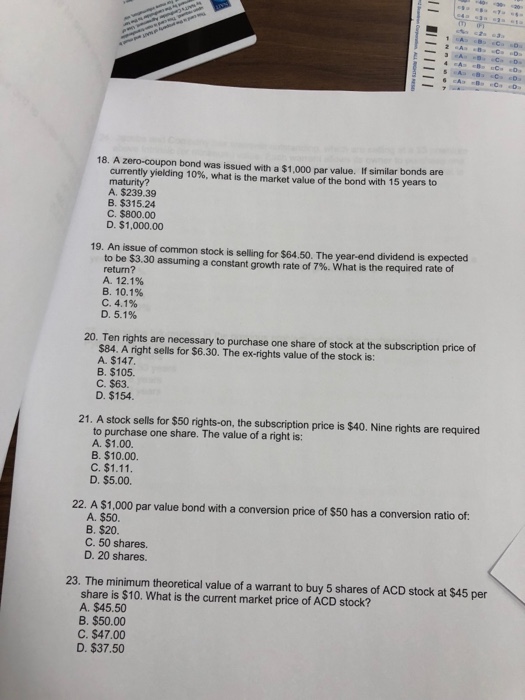

Zero-Coupon Bond: Formula and Calculator [Excel Template] If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Zero-Coupon Bond Value Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Formula we can calculate the Present value of using this below-mentioned formula: Zero-Coupon Bond Value =Maturity Value/ (1+i)^ Number of Years You are free to use this image on your website, templates, etc, Please provide us with an attribution link Example Let's understand the concept of this Bond with the help of an example:

Bond valuation and bond yields | P4 Advanced Financial ... The plain vanilla bond with annual coupon payments in the above example is the simpler type of bond. In addition to the plain vanilla bond, candidates – as part of their Advanced Financial Management studies and exam – are required to have knowledge of, and be able to deal with, more complicated bonds such as: bonds with coupon payments occurring more frequently than once a year ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Reserve Bank of India - Frequently Asked Questions Zero Coupon Bonds – Zero coupon bonds are bonds with no coupon payments. However, like T- Bills, they are issued at a discount and redeemed at face value. The Government of India had issued such securities in 1996. It has not issued zero coupon bonds after that.

PDF Numerical Example in Valuing Zero coupon Bonds - New York University For example, the value of a zero coupon bond will increase from $385.00 to $620.92 as the bond moves from 10 years to maturity to 5 years to maturity assuming interest rates remain at 10%. 4) Compare the value of the zero at 10 years to maturity when rates are 10% versus when they are 7%. Lower interest rates mean higher bond prices.

All the 21 Types of Bonds | General Features and Valuation | eFM 13.06.2022 · Different Types of Bonds Plain Vanilla Bonds. A plain vanilla bond is a bond without unusual features; it is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at face value. It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon …

Zero Coupon Bond Calculator - What is the Market Value? The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000

Fundamentals of Finance | Coursera Holding Period Return and Yield to Maturity for Zero-Coupon Bonds 10m. Calculating the Holding Period Return on a Coupon Bond 10m. Topic 3 Lecture Slides 10m. Topic 3 Lecture ... between fixed-income securities, such as bonds, and equity cash flows. You’ll discover the standard approach in valuing equity through its cash flow and how the ...

Pricing of Swaps, Futures, & Forward Contracts | CFA Institute With a basic understanding of pricing and valuing a simple interest rate swap, it is a straightforward extension to pricing and valuing currency swaps and equity swaps. The solution for each of the three variables, one notional amount (NA a ) and two fixed rates (one for each currency, a and b), needed to price a fixed-for-fixed currency swap are :

Bond valuation and bond yields | P4 Advanced Financial … Since the bonds are all government bonds, let’s assume that they are of the same risk class. Let’s also assume that coupons are payable on an annual basis. Bond A, which is redeemable in a year’s time, has a coupon rate of 7% and is trading at $103. Bond B, which is redeemable in two years, has a coupon rate of 6% and is trading a t $102.

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until maturity If...

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://img.homeworklib.com/images/0fb28cf1-6886-41b8-9d2e-0f4dc641a9e7.png?x-oss-process=image/resize,w_560)

Post a Comment for "42 valuing zero coupon bonds"